ESG funds

Also known as sustainable funds or socially responsible investment (SRI) funds, ESG funds (environmental, social and governance factors) aim to make a concrete, positive impact on our lives, our society and our environment, without compromising on returns!

Get expert advice

What is Socially Responsible Investing (SRI)?

SRI funds have to meet specific investment criteria that:

- Take environmental, social and governance (ESG) factors into consideration, as well as financial analysis

| Environmental | Social | Governance |

|---|---|---|

| Environmental protection | Relationships with employees, clients and communities | Governance practices |

| Fight against climate change | Work conditions | Executive compensation |

| Resource sustainability | Health and safety | Anti-corruption practices |

| Pollution reduction | Respect for local communities | Board of director diversity |

- Meet multiple financial criteria for companies, in addition to:

o its business model

o its competitive advantages

o the quality of its management team - Combine the best of both worlds: superior growth potential and positive social and environmental impact.

This makes it possible to invest in companies that respect your values and help build a sustainable world for you and your family. We are proud to present a wide range of ESG funds for your financial goals, your retirement, your children’s education, and more. A perfect balance between your values and your financial goals, whatever your budget!

DID YOU KNOW?

- 77% of investors believe that companies with good ESG practices make better long-term investments.

- ESG funds, or socially responsible investment funds, go beyond green funds or green investments since, in addition to an environmental dimension, they encompass a social and governance dimension.

Our ESG fund lineup

The SRI (Inhance) fund family

- SRI Moderate (Inhance)

- SRI Balanced (Inhance)

- SRI Growth (Inhance)

Why choose these ESG managed solutions?

- Turnkey managed solutions for investors who want to invest responsibly to meet their financial goals

- Reduce non-traditional risk: the team incorporates ESG analysis into traditional financial analysis

- Three asset allocations to match your investor profile and risk tolerance: Moderate, Balanced and Growth

Inclusion criteria

SRI (Inhance) funds aim to invest in companies that are progressive in the development of renewable energy and water treatment infrastructure or that are involved in finding cures for life-threatening diseases.

Specifically, for fixed income securities, for example, Vancity aims to invest in:

- "Green" bonds: clean transportation, energy efficiency or conservation, etc.

- Bonds with a social impact: affordable housing, basic infrastructure, poverty reduction, food security, etc.

Exclusion criteria

Vancity does not invest in securities issued by companies operating in the following sectors:

Why did we choose Vancity for our ESG managed solutions?

Vancity is a socially responsible investment partner that stands out in the following key areas:

- Expertise: Vancity launched the first SRI fund in Canada in 1986

- Visionary: Vancity was the first manager in Canada to adopt the United Nations Principles for Responsible Investment (PRI).

Founded in 1995, Vancity Investment Management is one of Canada's leading responsible investment managers. Our goal is to help Canadians achieve their investment objectives in a way that reflects their commitment to progressive values.

Sustainable Balanced Portfolio (iA)

Why choose this fund?

- Exclusive to iA Financial Group

- An all-in-one solution for sustainable investing (ESG funds, green bonds, environment, etc.)

- Active management approach to asset allocation based on economic and market forecasts

- Target allocation: 50% equity and 50% income funds

iA Global Asset Management is one of Canada’s largest asset managers. It oversees more than $100 billion across a broad range of retail and institutional mandates with expertise encompassing all asset classes.

To learn more: iagam.ca

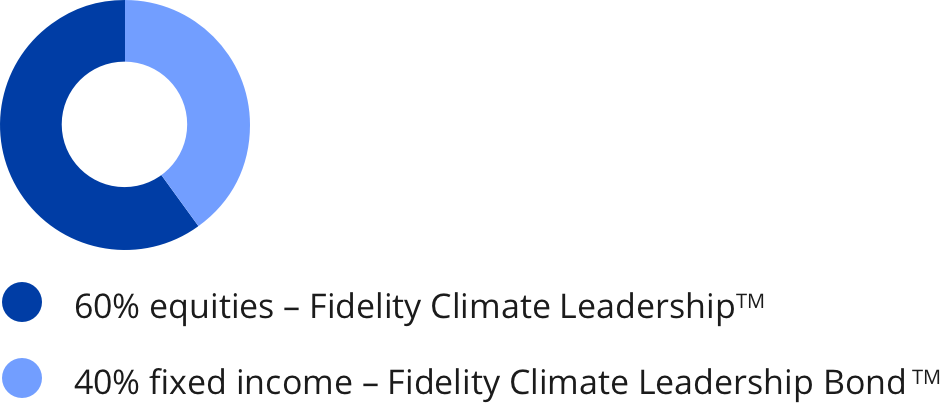

Fidelity Climate Leadership BalancedTM

Why choose this fund?

- A balanced investment approach focused on climate and decarbonization

- A combination of two separate strategies (60% equity + 40% fixed income) that can generate strong risk-adjusted returns across market cycles

Founded in 1946, as of June 2022, Fidelity has over US$3 trillion under management and is one of the world's largest financial services providers.

Sustainable Canadian Equity (iA)

Why choose this fund?

- Exclusive to iA Financial Group

- Investment in companies that provide conditions for long-term growth by incorporating sustainable investment factors

- Supporting companies that adopt best practices in sustainable investing relative to the peer group (80%)

- Thematic investment in specific ESG-focused solutions (20%)

iA Global Asset Management is one of Canada’s largest asset managers. It oversees more than $100 billion across a broad range of retail and institutional mandates with expertise encompassing all asset classes.

To learn more: iagam.ca

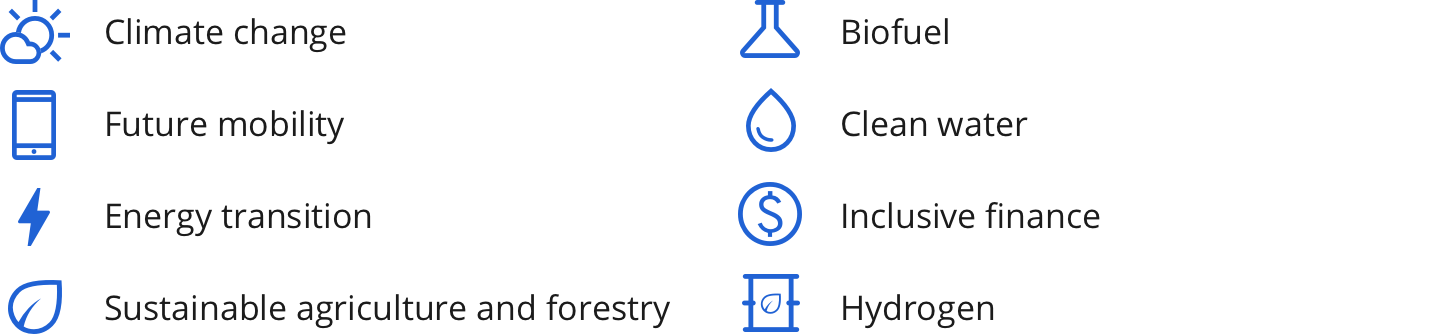

Climate Strategy (Wellington)

Why choose this fund?

- Strategy not currently offered elsewhere in Canada

- A global equity fund that makes a positive contribution to climate risk mitigation;

- Strategy that treats the environment as a return opportunity, not just a risk or cost;

- Investment focus on five main categories:

Wellington Management is one of the world's largest independent investment management firms with over $1.8 trillion in assets under management.

Funds selected with care!

In addition to funds managed by our in-house team of portfolio manager iA Global Asset Management (iAGAM) and supported by the expertise of Maggie Childe, its Head of Sustainable Investing, we have selected a fund offering managed by the world's leading sustainable investment management firms such as Fidelity Investments, Vancity and Wellington Management.

ESG factors are examined from the perspective of four key stakeholders: shareholders, clients, employees and communities. The interests of these stakeholders must be balanced across environmental performance, social responsibility, corporate governance, and profits.

For example, before investing in a stock, our portfolio managers will analyze whether the company:

- Has a code of conduct or ethics

- Designs products that contribute to sustainable development

- Has significant environmental policies and objectives

- Contributes to a retirement plan and health insurance for its employees

- Is committed to increasing gender parity and ethnic diversity

- Donates a percentage of its profits to charities OR

- Has policies in place to protect employees and the community from human rights violations

Companies with securities in our ESG funds are regularly monitored to ensure continued compliance with our responsible investment standards. Monitoring technologies are used to identify significant changes within companies and to check for exposure to emerging risks or serious incidents.

Proactive engagement with companies to achieve positive results

Our portfolio managers also actively engage with industry leaders to encourage them to increase their sustainability commitments. Their goal is to start a positive chain reaction throughout all branches of the industry.

Superior potential performance

Lower performance with socially responsible funds? Wrong! Sustainable investing is not an "OR" but an "AND": choosing this type of investment can generate better financial returns than non-sustainable benchmarks AND have a concrete social and environmental impact. See our Fund Performance and Overview to compare the performance of our ESG funds. You’ll see they’re more than a match for other types of funds!

Interested in investing in one of our socially responsible funds? Contact one of our financial security advisors who can provide you with guidance, taking your reality and needs into consideration.