Advice in times of market volatility

Economics, inflation and market volatility: what are the best strategies to take? Follow these tips to stay informed as an investor.

Factors that have an impact on market volatility

Firstly, it’s important to understand the factors affecting market volatility. The causes are complicated, but can be grouped into three main points:

Inflation: Rising inflation over a period of time. To curb inflation, central banks are increasing interest rates. This makes borrowing money less attractive, which should slow down the economy.

News: Large-scale health crises and political tensions are examples of factors that can create a climate of uncertainty in the markets. These types of factors have many effects on the job market and on the economy.

Receding optimism: Even when we’re in a favorable environment where markets have been performing well for quite some time, a climate of uncertainty can easily shake investors' high expectations. Combined with a dip in consumer confidence, optimism in the markets is rapidly declining.

1. Stay calm

What’s an investor’s worst enemy?

Though it’s normal to have concerns, staying calm is always the best strategy for savvy investors. Investors who let their emotions drive them risk entering and exiting the stock market at the wrong times, reducing the return on their investment portfolio.

As illustrated in the chart below, a bull market gives investors enthusiasm and overconfidence and makes them feel like now is the best time to invest further. A bear market, on the other hand, causes fear, panic and despair, and makes investors think about selling everything quickly to save their money. In both cases, if investors let themselves be guided by their emotions, they may see decreased returns or miss out on opportunities for gains.

2. Assess your personal situation and keep your original goals in mind

The best investment choices depend on a number of factors: family situation, dependants, current financial situation, assets, liquidity needs, risk tolerance, investment knowledge, etc. The amount invested and to be invested, the time you have before you retire and your risk tolerance are the three main factors you should consider.

Investor profiles

Each investor has a different personal situation and a unique investor profile. It’s important to always keep in mind your initial investment goals as well as your investment horizon. This will help you make sure your emotions don’t interfere with your investments.

3. Avoid the trap of exiting the market too soon

To avoid the risk of an impulsive disbursement, take the time to put your situation in perspective and consider all the advantages of long-term investing.

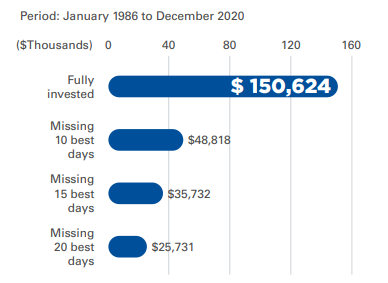

To better understand the trap of early disbursement, let’s look at this scenario with an investor who invested $10,000 in 1986. By missing the 10 best stock market days of the last 39 years*, he would have $136,467 less in his portfolio in 2025 than if he had left his money invested.

As illustrated in the chart above, the unpredictability of stock markets does not allow us to know when the best days to be invested will occur and missing out on those can make a significant difference in the long run. Those who choose to cash out due to a bear market risk locking in their losses and losing out on the eventual rebound.

4. Be curious but stay alert!

We are in the age of easily accessible information but there are pitfalls to be cautious of. These include the spread of misinformation or disinformation, privacy concerns, increased distraction, and a potential decline in critical thinking and deep focus.

Social media is full of content that can influence your beliefs and affect your trust in institutions. So be careful not to fall victim to disinformation or to get caught in echo chambers where you basically only encounter information and opinions that reinforce your existing beliefs. This phenomenon can limit exposure to diverse perspectives and contributes to the polarization of opinions.

It’s important to get your information from a variety of sources for a more accurate and informed picture of the situation. Be curious and find out which ones speak to you the most!

Read, watch and listen. From organisms, to magazines, newspapers, blogs and podcasts, there are many different platforms where you can find financial and economic news. In a hurry and short on time? Podcasts are becoming more and more popular and offer an easy way to learn while you’re getting things done or during your commute.

5. Ask for advice

Your financial advisor is your best ally and we encourage you to contact them when you need to so you can make informed decisions about your financial future.

Still don’t have an advisor? Make the first step towards your financial future!

In short

- Don’t let your emotions take you in the wrong direction

- Stay calm, avoid reacting too quickly

- Assess your personal situation

- Take the long view and stay invested

- Get informed

- Ask for advice

* Source: Bloomberg. TSX Composite Index total returns from January 1, 1986, to May 22, 2025. Past performance is no guarantee of future results.

Need advice?

Contact an advisor near you. Our advisor profiles will help you make an informed choice and find someone who inspires you.

Advice Zone and economic news

Whatever product you’re interested in, the following tools will give you an idea of how much to invest, which you can then discuss with your advisor.