From a financial planning perspective, we all face a common challenge from time to time: striking the right balance between short-term and long-term objectives.

While short-term objectives often target concrete, “fun” goals—a great vacation opportunity, buying a luxury car, or even a boat, etc.—long-term objectives are a harder sell, since they generally have to do with more intangible considerations, such as financial security in retirement… sometimes 20+ years down the road. Which is why we can be tempted to sometimes satisfy the urge of short-term exhilaration and withdraw from a long-term savings account such as our group RRSP.

However, dipping into your RRSP before retirement comes with financial consequences, both in the short and long term. It’s as if you were actually double dipping (which is always frowned upon!).

Early RRSP withdrawals can hurt you twice

Why is it costly now?

In addition to a withdrawal fee averaging $50, an early withdrawal from your group RRSP will cause you to pay more income taxes, as your income is higher now than in retirement.

For example, if you want to withdraw a net amount of $2,000, in fact, you would have to withdraw $2,857 now ($857 of withholding taxes) compared to $2,500 at retirement ($500 of withholding taxes), since your income and marginal tax rate will be lower then. 1

Why is it even more costly at retirement?

Your group RRSP was set up to help you save for retirement. Using it to fulfill present-day financial needs will set back your chances of reaching your retirement goals.

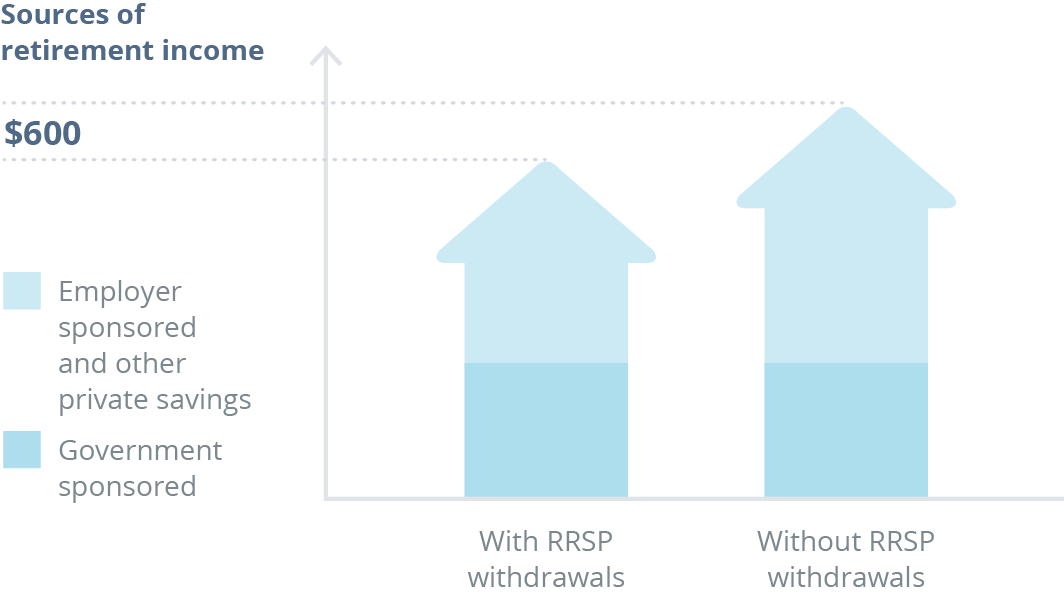

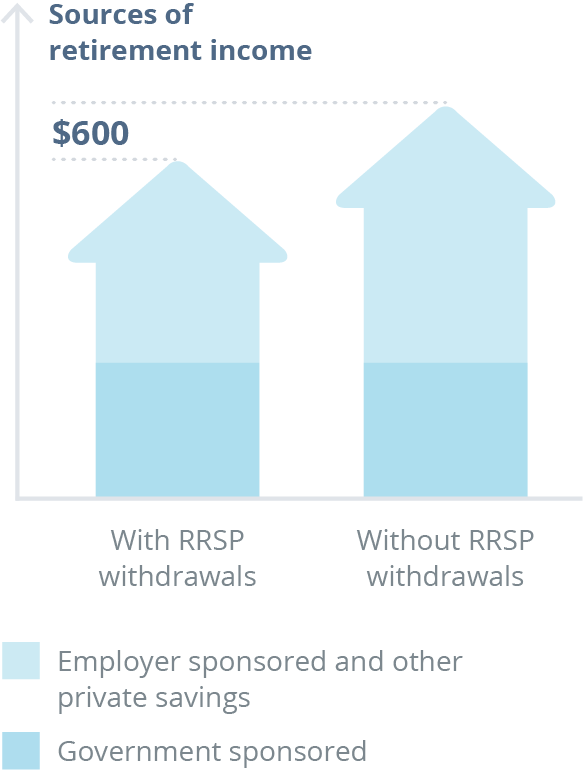

Still using the example above, if the $2,000 net withdrawal occurs at age 30, the actual amount withdrawn, i.e., $2,857, would have ended up totalling around $11,000 at age 65—thanks to compound interest—using a 5% annual rate of return. Ultimately, what this means is that in this example the early RRSP withdrawal would end up costing you $600 per year in your retirement income.

Time works against late savers

For an amount withdrawn at age 30, it would take a deposit of more than double that amount at age 50 to achieve the same accumulated savings and the same retirement income at age 65.

| Amount saved | Age | Worth at age 652 |

|---|---|---|

| $2,000 | 30 | $11,000 |

| $5,300 | 50 | $11,000 |

Other negative consequences

What’s more, if the employer contributes to the group RRSP, withdrawals of employer contributions can be subject to a penalty, and lost RRSP contribution room is not restored the following year.

Strategies to avoid withdrawing from your group RRSP

If withdrawals are due to financial constraints:

- See whether debt payments (e.g., mortgage payments) can be lowered until your financial situation is back on track

- Consolidate debts with a financial institution to lower interest fees and payment

If withdrawals are related to unplanned purchases:

- Prepare and follow a budget so you can be aware of your income and expenses, and set aside an amount for unplanned purchases or rewards on special occasions

- Ask yourself, before buying something: Does that product or service meet a need or a want? Could I do without it?

- Before buying the latest product, sleep on it and see if the need persists

Other alternative strategies:

- Consider having a line of credit

- If you have non-registered assets such as GICs or savings bonds, consider using them first

- Consult a financial advisor who can help you identify the best strategies for you

| 1 | Using a hypothetical example based on an Ontario resident earning $50,000 in 2017 and expecting to earn $35,000 at retirement (equal to 70% of pre-retirement income, which experts agree should be sufficient to maintain a similar lifestyle). Every person’s situation is different, and marginal tax rate varies in each jurisdiction. A personal financial or tax advisor should be consulted to learn specific details that apply to your situation. |

| 2 | Amount rounded, using a 5% annual rate of return. |